Banking on Gold

Deep below the Earth’s surface, in the veins of our planet, there lies a precious element, one that has been sought after for millennia – gold. For countless generations, people have valued gold for its luster, malleability, and, most importantly, its scarcity. Gold has served as a symbol of wealth and a store of value, enduring through the rise and fall of civilizations, maintaining its value amidst the most tumultuous of economic times, and the recent 2023 Central Bank Gold Reserves Survey from the World Gold Council (WGC) reaffirms its enduring value. This study shows that many central banks worldwide plan to increase their gold reserves over the next five years, underlining gold’s rising appeal as a strong asset1.

The WGC survey also reveals a shift in attitudes towards the US dollar. Half of the central banks anticipate that their reserves in USD will be between 40-50% in five years, while just over a quarter believe it will remain unchanged1. This indicates a potential market shift and a golden opportunity for those ready to diversify their portfolios with gold.

The survey finds that 24% of central banks plan to enhance their gold reserves in the upcoming year. Moreover, 62% of central banks predict that gold will account for a larger proportion of total reserves, up from 46% the previous year1. These trends also suggest a growing confidence in gold as a valuable asset.

Now, we’re not in the age of gold rushes anymore, we’re in the digital age. With the advent of blockchain technology, a revolutionary way to harness the value of gold has emerged, G-Coin®.

The G-Coin® wallet is a user-friendly mobile app that allows you to buy, sell, send, and hold gold. Whether you are a seasoned gold buyer or a newcomer, G-Coin® provides a straightforward and secure way to own 24k, 99.99% pure, and responsibly sourced premium gold called, Responsible Gold™.

G-Coin® (Digitized Responsible Gold™)

Your journey with G-Coin® starts where all gold journeys begin: in the mine. But not just any mine. Responsible Gold™ comes from mines that follow best-in-class environmental, social, and governance (ESG) practices. These mines are committed to ensuring that their operations meet the highest standards in terms of both environmental impact and the wellbeing of their workers and communities.

The gold is then transported to world-renowned, LBMA Good Delivery certified refineries, where it’s refined into 99.99% pure 24k gold – the kind of premium gold typically reserved for institutional investors, banks, and high-end jewelers. The gold is then secured and certified in licensed vaults in Switzerland, a country known for its stringent regulations and high safety standards. This gold is affirmatively declared Responsible Gold™.

Now, here’s where the magic happens. Qenta Inc., the company behind G-Coin®, uses proprietary blockchain technology to digitize this Responsible Gold™. Each G-Coin® is a digital title to 1 gram of this premium, conflict-free gold. The blockchain also allows users to track the gold’s provenance, providing an immutable record of its journey from the mine to the vault, where it is stored as gold kilo-bars. Each kilo-bar’s identity is verified on the blockchain, preventing fraud and counterfeit bars from entering the ecosystem.

Trusted. Secure. Easy.

When you own a G-Coin®, you don’t just own a piece of gold – you own a piece of a Responsible Gold™ kilo-bar, whose history, authenticity, and integrity you can trust… but the real beauty of G-Coin® is that you don’t have to worry about storing the gold yourself. You don’t have to pay for shipping or insurance fees, and you don’t have to worry about it getting lost or stolen. The gold is insured, and it’s always there, safely held in a certified vault, while you hold the digital title to it in your G-Coin® wallet on your smartphone. With G-Coin®, you are joining a global community of gold enthusiasts who recognize the power and potential of gold ownership, from the palm of their hands.

As central banks worldwide continue to grow their gold reserves, it’s clear that gold is not just a relic of the past but a vital part of the future of finance.

A Decade of Gold vs. The Dollar

Our analysis begins in 2014, tracing the journey of gold and the USD over almost a decade. We start with $1 worth of gold and $1 in cash, and we compare how their values evolve until 2023.

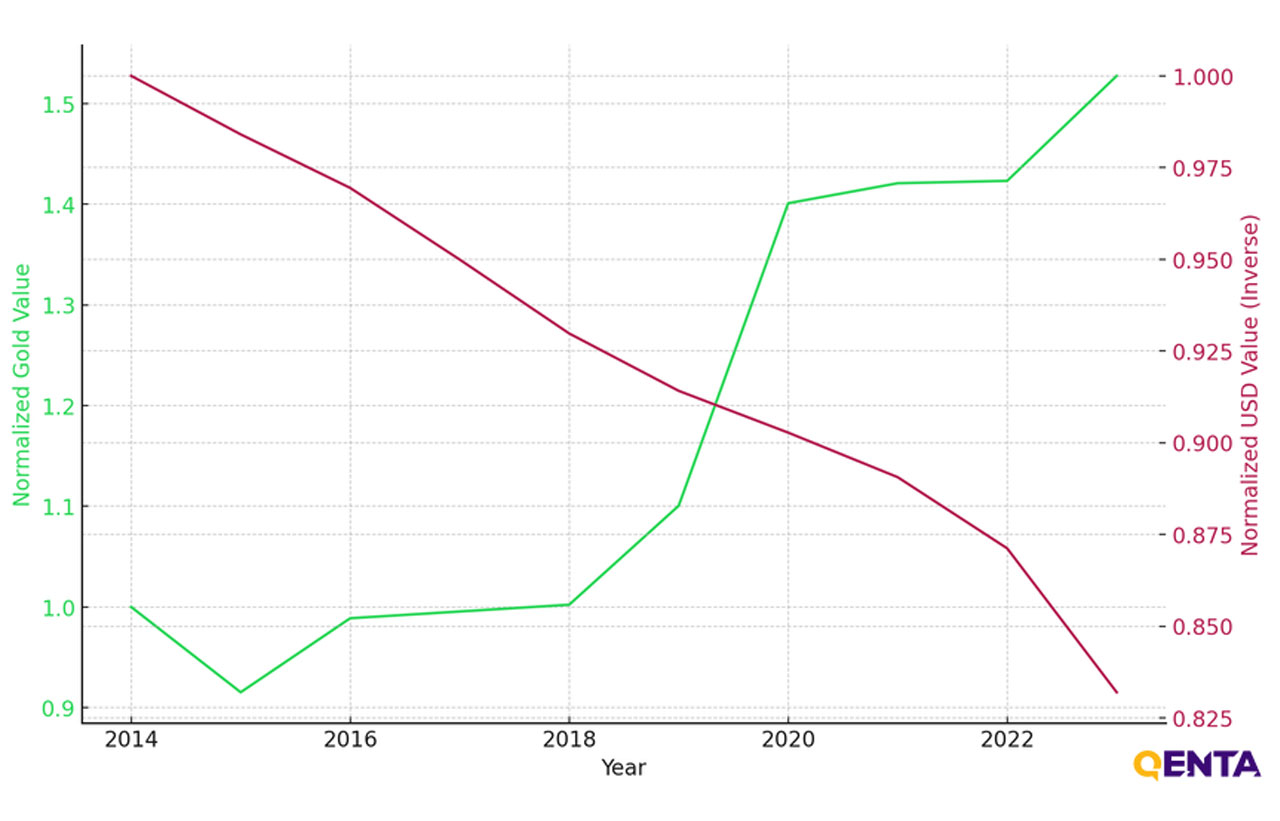

The results are telling. As the chart below shows, the value of $1 worth of gold in 2014 has increased over the years, while the purchasing power of $1 has decreased.

Figure 1: $1 Normalized Gold Value vs $1 Normalized USD Value (Inverse) (2014-2023)

The above chart compares the average price of Gold and the purchasing power of the USD from 2014 to 2023. We’ve adjusted, or “normalized,” both so we can compare them directly. “Normalization” is a process used in data analysis and statistics to adjust values measured on different scales to a common scale. For Gold, we divided the price each year by the 2014 price. For USD, we used the inverse because as the dollar amount increases, what it can buy decreases due to inflation. So, the chart helps us see how Gold’s price and the buying power of the USD have changed over time.

From the chart, we can see that as the value of USD decreases (purchasing power decreases), the value of Gold has generally increased. There are also periods of decline for Gold, but the overall trend over almost a decade is that the value of Gold increases as the purchasing power of the USD decreases.

This trend underscores a fundamental truth about gold and fiat currencies: gold has maintained its value over time, while the buying power of cash erodes due to inflation.

Read about the benefits of a portfolio allocation in gold as well as how Responsible Gold™ and G-Coin® compare favorably with traditional investment products here: https://gcoin.com/wp-content/uploads/2022/11/Portfolio-Allocation-Benefits.pdf

The Erosion of the Dollar

Inflation is the rate at which the general level of prices for goods and services is rising and subsequently, the purchasing power of currency is falling. Over the past decade, the USD has seen its buying power decrease steadily.

This is a significant concern for anyone holding cash. Savings in the bank may be safe from market fluctuations, but they are not safe from the eroding effects of inflation.

Gold: A Store of Value

On the other hand, gold has proven to be a reliable store of value. The price of gold per ounce has generally increased over the past decade, leading to an increase in the value of gold holding. This is partly because gold is seen as a safe haven during times of economic uncertainty, causing demand, and therefore prices, to rise.

The relative stability and increasing value of gold over time have led many investors and banks to turn to gold as a hedge against inflation and currency devaluation.

G-Coin® represents the perfect marriage between the ancient value of gold and the cutting-edge technology of the digital age. Begin your gold journey with as little as a quarter gram. Make small, regular purchases with G-Coin® and grow your holdings over time. For more details, check out our website and download the G-Coin® app today from supported jurisdictions at G-Coin® | A new way to own gold | Responsible Gold.

Note: This article is inspired by the World Gold Council’s 2023 Central Bank Gold Reserves Survey.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in gold or any other commodity involves risks, including potential loss of principal. Readers should consider their individual financial circumstances and conduct thorough research before making any investment decisions. Past performance of gold or any other investment does not guarantee future results. This article may contain links to third-party websites or resources. These links are provided for your convenience and do not signify our endorsement or responsibility for the content, accuracy, or availability of these external sites or resources. We have no control over the nature, content, and availability of those sites.

The mention of specific products, services, companies, or investments within this article does not constitute or imply endorsement, sponsorship, or recommendation by us.

Leave A Comment